Introduction: Why Poland is a Global Tech Powerhouse

Poland has firmly established itself as a premier destination for IT offshoring, nearshoring, and team augmentation, attracting global businesses with its potent combination of a highly skilled workforce, competitive costs, and a stable, business-friendly environment. As companies worldwide seek to accelerate their digital transformation and build robust, scalable technology teams, Poland has emerged as a strategic hub for innovation and growth. This comprehensive guide explores the Polish IT landscape, providing in-depth analysis of the market, its key players, and the compelling reasons why Poland is the go-to choice for enterprises looking to build high-performing technology teams.

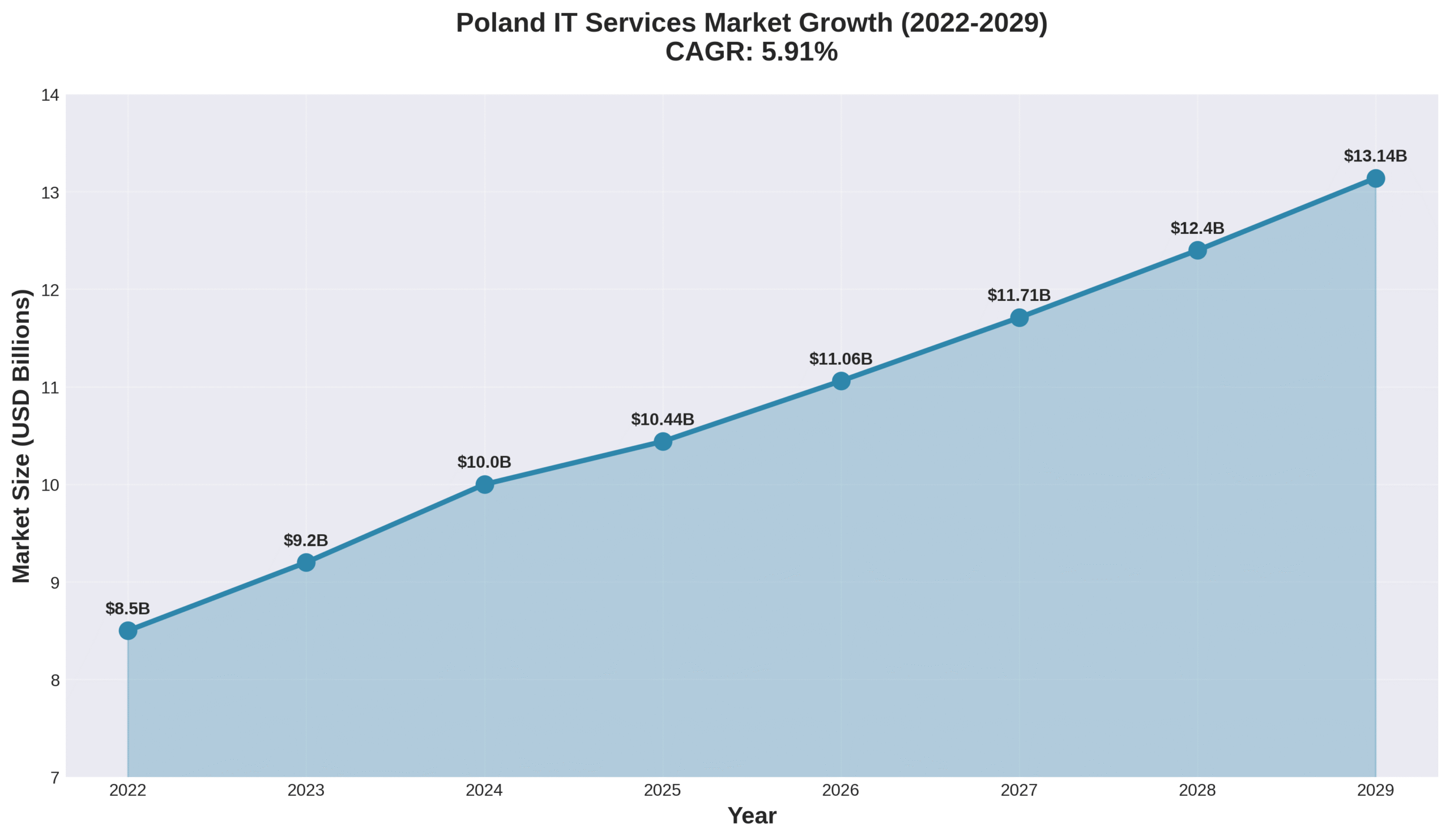

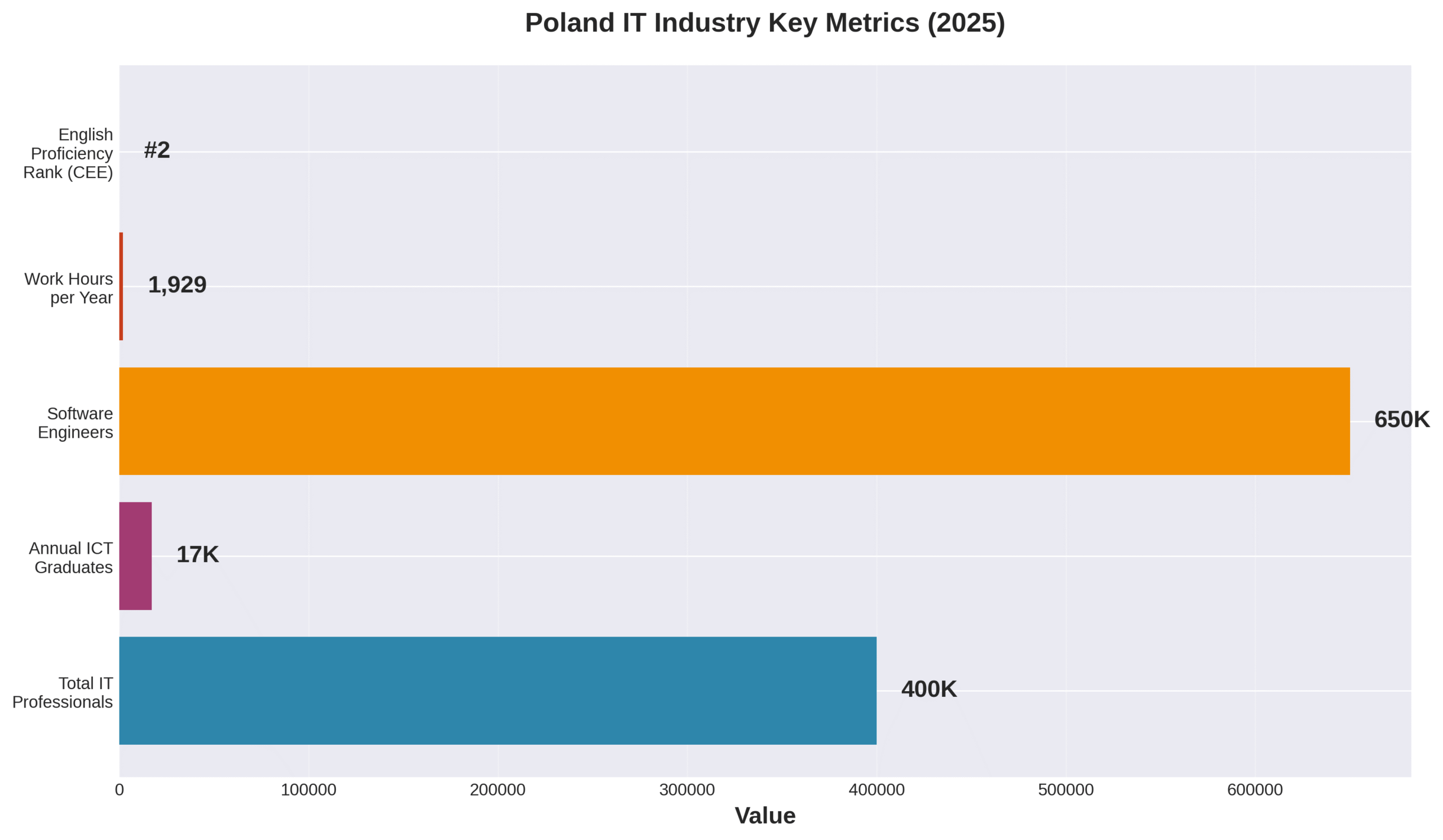

The Polish IT market is experiencing remarkable growth, with projections indicating a market size of over $13 billion by 2029 [1]. This expansion is fueled by a confluence of factors, including a massive talent pool of over 400,000 IT professionals, a strong emphasis on STEM education that produces 17,000 ICT graduates annually, and a vibrant ecosystem of tech hubs in cities like Warsaw, Kraków, and Wrocław [2]. Furthermore, Polish developers are consistently ranked among the best in the world for their technical skills and problem-solving abilities, making them a valuable asset for any organization.

This article will delve into the specifics of the Polish IT market, providing a detailed overview of the top offshoring and team augmentation companies. We will analyze market trends, cost advantages, and the unique value proposition that Poland offers.

We will also feature a detailed profile of Correct Context, a leading firm specializing in building and scaling core engineering teams in Poland, to provide a real-world example of how companies can leverage the Polish talent pool to achieve their strategic objectives.

Growth of Poland's IT Services Market

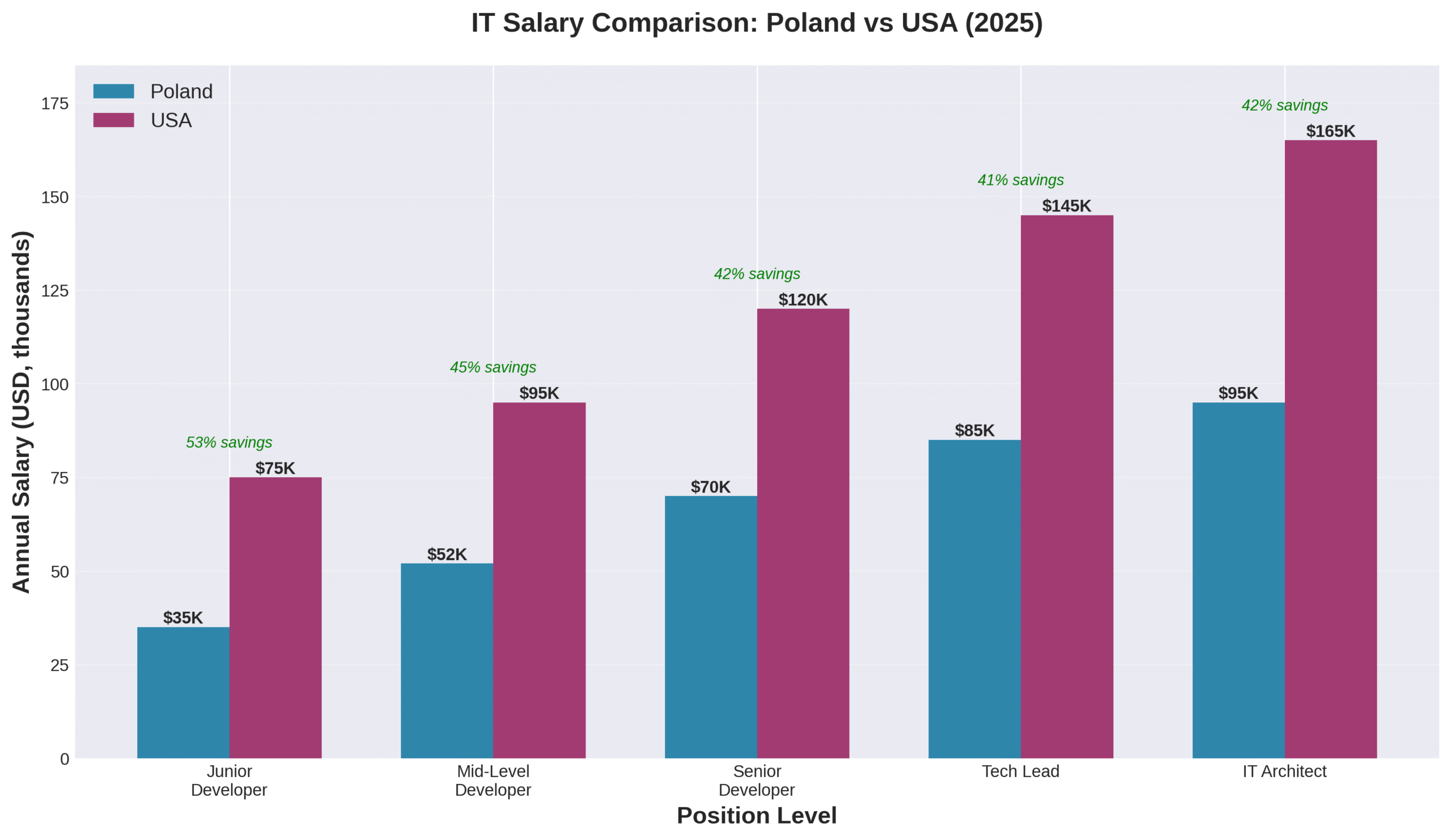

Engineering Salary Comparison Poland vs. the US

A Thriving Talent Pool

Poland’s greatest asset is its people. The country boasts a large and growing talent pool of over 400,000 IT professionals, with a steady stream of new talent entering the market each year [2]. Polish universities are renowned for their strong STEM programs, producing highly skilled graduates who are well-versed in the latest technologies. This abundance of talent, combined with a strong work ethic and high English proficiency, makes Poland an ideal location for building and scaling technology teams.

Poland's IT workforce

Top IT Offshoring and Team Augmentation Companies in Poland

Poland is home to a diverse ecosystem of IT outsourcing companies, ranging from large multinational corporations to specialized boutique firms. This section provides an overview of the top companies in the Polish market, highlighting their strengths, specializations, and key offerings.

Correct Context: Your Partner for Building Core Engineering Teams

At the forefront of the Polish IT team augmentation landscape is Correct Context, a firm that specializes in helping global enterprises build, scale, and manage high-performing core engineering teams.

With a deep focus on AI, Big Data, backend, and cloud technologies, Correct Context provides a comprehensive suite of services that go beyond traditional recruitment.

Core Services

- Rapid Hiring & Scalable Growth: Correct Context can recruit and onboard elite engineering teams in as little as 4-6 weeks per position, enabling companies to scale from a handful of developers to over 100 hires within a year.

- Top 5% Talent at 40-60% Lower Cost: By tapping into Poland’s vast talent pool and employing a rigorous vetting process, Correct Context ensures that clients get access to the top 5% of engineers at a fraction of the cost of hiring in the US.

- Full-Service EOR & Operational Support: As an Employer of Record (EOR), Correct Context handles all local employment and administrative operations, including contracts, payroll, benefits, tax compliance, and IP protection. They also provide support for office setup, equipment provisioning, and visa assistance, offering a truly seamless expansion experience.

A Proven Track Record

Correct Context has a proven track record of success, having helped numerous companies build and scale their technology teams in Poland. One of their most notable success stories is their partnership with Comscore, a NASDAQ-listed media measurement and analytics company. Correct Context helped Comscore scale its engineering and support teams to over 140 professionals in just under two years, enabling the company to accelerate its product development and strengthen its competitive position.

Other Leading Companies

While Correct Context stands out for its specialized focus and comprehensive service offering, several other companies also play a significant role in the Polish IT outsourcing market. The following table provides a comparative overview of some of the top players:

| Company | Revenue (2024) | Employees (Poland) | Founded | Key Services |

|---|---|---|---|---|

| Asseco Poland | PLN 17.1B (group) | 33,000+ (global) | 1991 | Custom software, IT systems, digital government, IT outsourcing |

| Sii Poland | PLN 2.13B | 7,700+ | 2006 | IT specialist leasing, software development, QA testing, infrastructure management, BPO |

| Comarch | PLN 1.916B | 6,500+ | 1993 | ERP, CRM, telecom software, custom software development, IT infrastructure, cloud hosting |

| Transition Technologies MS | PLN 233.7M | 800+ | 2015 | Managed services, IT outsourcing for pharma, manufacturing, defense; AEM, Azure, Salesforce, BI, AI |

| Devire | ~PLN 180M (est.) | 300+ | 2012 | IT staff augmentation, permanent recruitment, nearshoring solutions, external employment |

| AlcorBPO | ~PLN 50M (est.) | 100+ | 2016 | IT recruitment, nearshoring consulting, team building, market intelligence |

| ITMagination | ~PLN 45M (est.) | 150+ | 2008 | Nearshore software development, data analytics, cloud solutions, team augmentation |

Conclusion: The Future of IT Offshoring is in Poland

Poland has undeniably cemented its position as a global leader in the IT offshoring and team augmentation market. With its vast and highly skilled talent pool, significant cost advantages, and a thriving tech ecosystem, the country offers a compelling value proposition for businesses of all sizes. As the demand for top-tier tech talent continues to grow, Poland is poised to play an even more critical role in the global technology landscape.

For companies looking to build high-performing, scalable, and cost-effective technology teams, Poland is not just an option; it is a strategic imperative. By partnering with a firm like Correct Context, businesses can navigate the complexities of the Polish market and unlock the full potential of its world-class talent, ensuring long-term success and a sustainable competitive advantage.

References

[1] Statista. (2025). IT Outsourcing – Poland. Retrieved from https://www.statista.com/outlook/tmo/it-services/it-outsourcing/poland

[2] Correct Context. (2025). Correct Context Overview. (Provided document)

[3] Alcor. (2025). Is IT Outsourcing to Poland Still a Trend in 2025?. Retrieved from https://alcor-bpo.com/it-outsourcing-to-poland-overview/

[4] Alcor. (2025). Polish Developers: Pros, Cons, Salaries & Insights. Retrieved from https://alcor-bpo.com/polish-developers-pros-cons-rates-insights/

[5] TTMS. (2025). Top 7 Polish IT outsourcing companies in 2025 – ranking. Retrieved from https://ttms.com/top-7-it-outsourcing-companies-in-2025-ranking-of-the-best-polish-providers/

[6] Brainhub. (2025). 10+ Top Software Development Companies in Poland [2025]. Retrieved from https://brainhub.eu/library/top-software-development-companies-poland