In 2026, the question is no longer *if* your enterprise will adopt AI, but *how* it will leverage AI to survive and thrive. For corporations in the fast-paced FinTech, Software, and Media sectors across the United States, the future is not just coming–it is here, powered by a convergence of Software-as-a-Service (SaaS) and Artificial Intelligence. This is not another tech fad; it is a fundamental restructuring of how business is done. From automating complex decisions to creating entirely new revenue streams, the enterprise AI tools and strategies you deploy today will determine your market position for the next decade.

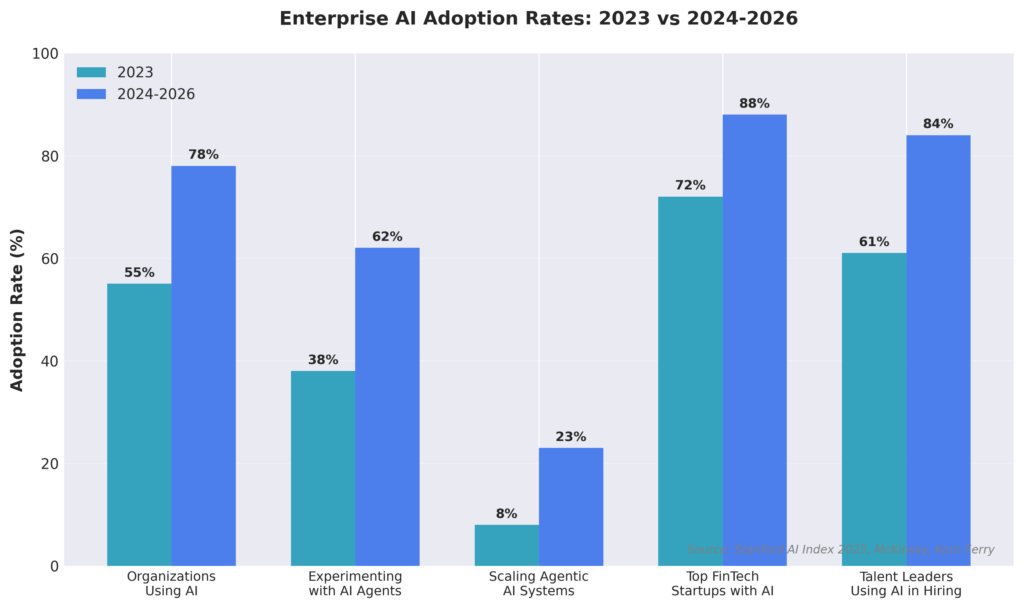

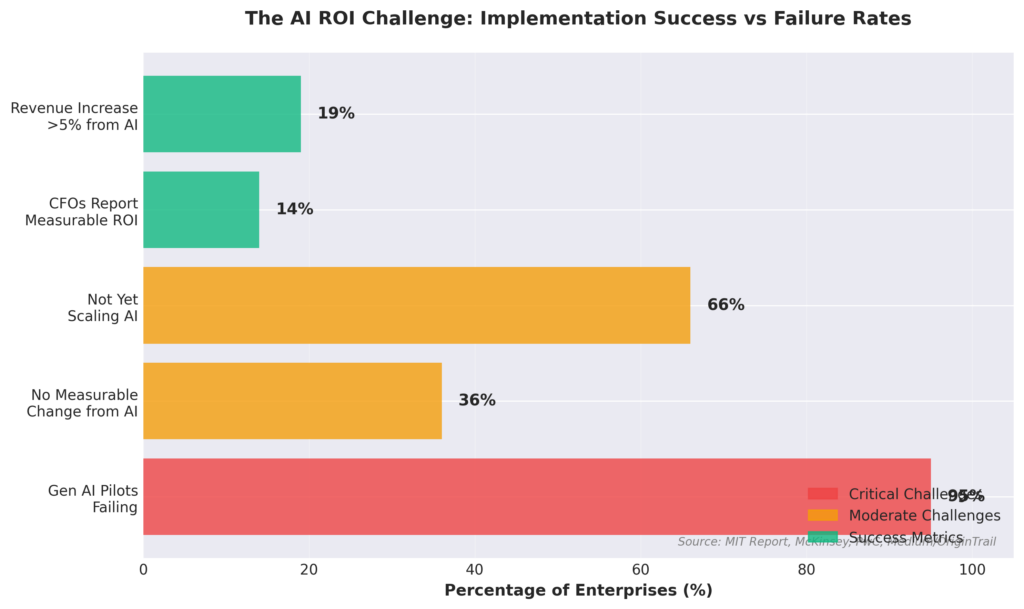

The numbers paint a stark picture of this new reality. The global SaaS market is on a trajectory to soar past $793 billion by 2029, propelled by an insatiable demand for cloud-based solutions [1]. Meanwhile, AI adoption has hit a critical mass, with 78% of organizations already integrating it into their operations [2]. Yet, a dangerous gap is emerging between ambition and execution. While executives are captivated by the promise of AI, a staggering 95% of generative AI pilots are failing to scale, and only 14% of CFOs report measurable ROI from their AI investments [3] [4].

This article is your guide through the noise. We will dissect the 20 most critical SaaS and AI trends that are not just on the horizon but are actively reshaping the corporate landscape in 2026. For leaders in FinTech, Software, and Media, understanding these trends is paramount. It is the difference between leading the charge and being left behind. We will explore the rise of corporate AI use, the strategic necessity to hire AI engineers, and the paradigm shifts that demand a new playbook for innovation.

Understanding the Landscape: Market Dynamics and Adoption Rates

Before diving into the specific trends, it is essential to understand the broader market dynamics at play. The convergence of SaaS and AI is not happening in a vacuum; it is driven by powerful economic forces, shifting customer expectations, and the relentless pace of technological innovation. The data reveals a market in the midst of a profound transformation.

The SaaS Market Explosion

The global SaaS market has experienced explosive growth over the past decade, and this trajectory shows no signs of slowing. In 2023, the market was valued at $273.55 billion, and it is projected to reach a staggering $1,228.87 billion by 2032, representing a compound annual growth rate (CAGR) of over 18% [1]. More conservatively, other analysts project the market to hit $793.10 billion by 2029, with an annual growth rate of 19.38% between 2025 and 2029 [1]. Regardless of the exact figure, the message is clear: SaaS is not just a delivery model; it is the dominant paradigm for enterprise software.

| Metric | Value | Source |

| Global SaaS Market Value (2023) | $273.55 billion | Email Vendor Selection |

| Projected Market Value (2029) | $793.10 billion | Vena Solutions |

| Projected Market Value (2032) | $1,228.87 billion | Email Vendor Selection |

| Annual Growth Rate (2025-2029) | 19.38% | Vena Solutions |

| Vertical SaaS CAGR | 23.9% | Tridens Technology |

| Enterprise Software Spend Increase (by 2027) | 40% | BetterCloud |

AI Adoption: From Experimentation to Scale

AI adoption has reached a critical inflection point. According to Stanford’s 2025 AI Index, 78% of organizations reported using AI in 2024, a dramatic increase from 55% the year prior [2]. This is not just about pilot projects; it is about production deployments. McKinsey’s State of AI survey reveals that 62% of organizations are at least experimenting with AI agents, and 23% are actively scaling agentic AI systems somewhere in their enterprises [14]. However, the path to scale is fraught with challenges. Nearly two-thirds of respondents indicate that their organizations have not yet begun to scale AI across the enterprise [14]. The gap between experimentation and enterprise-wide adoption remains a significant hurdle.

| AI Adoption Metric | Percentage | Source |

| Organizations Using AI (2024) | 78% | Stanford AI Index 2025 |

| Organizations Using AI (2023) | 55% | Stanford AI Index 2025 |

| Experimenting with AI Agents | 62% | McKinsey State of AI 2025 |

| Scaling Agentic AI Systems | 23% | McKinsey State of AI 2025 |

| Organizations Not Yet Scaling AI | ~66% | McKinsey State of AI 2025 |

| AI Adoption in Top FinTech Startups | 88% | WEZOM |

| Talent Leaders Using AI in Hiring | 84% | Korn Ferry |

The ROI Challenge

Despite the widespread adoption of AI, the return on investment (ROI) remains elusive for many organizations. A sobering statistic from recent research indicates that only 14% of CFOs report measurable ROI from AI to date [4]. This is compounded by the fact that 95% of generative AI pilots at companies are failing to scale, according to an MIT report [3]. The reasons for this failure are multifaceted, ranging from poor data quality and inadequate infrastructure to a lack of clear business objectives and organizational resistance to change. For enterprises, the lesson is clear: AI is not a magic bullet. Success requires a strategic, disciplined approach that goes beyond simply deploying the latest models.

Part 1: The New Economics of Enterprise AI

The financial models underpinning enterprise software are undergoing their most significant transformation in a generation. The old paradigms of per-seat licensing are becoming obsolete, replaced by dynamic, AI-driven pricing structures that align cost with value. For enterprises, this shift presents both immense opportunities for cost optimization and significant risks of unpredictable spending.

1. Agentic Enterprise License Agreements (AELAs)

The era of counting seats is over. Forward-thinking SaaS providers are introducing Agentic Enterprise License Agreements (AELAs), an all-you-can-eat pricing model designed for the age of AI agents. As companies deploy armies of AI agents to automate tasks, traditional per-user pricing becomes nonsensical. AELAs offer a flat-fee structure, providing budget predictability while encouraging widespread AI adoption. Salesforce, for example, has pioneered this model, offering customers a shared-risk agreement to scale their AI initiatives without fear of runaway consumption costs [5]. For corporations, this means you can use AI tools inside your corporation more freely, but it also demands a deeper understanding of long-term value and vendor lock-in.

2. Outcome-Based Pricing Models

Why pay for software when you can pay for results? This is the central premise of outcome-based pricing, a trend gaining significant traction. Gartner predicts that over 30% of enterprise SaaS solutions will incorporate outcome-based components by 2025. In this model, vendors tie their fees to specific business metrics–such as revenue generated, costs saved, or customer satisfaction scores. For FinTech companies, this could mean paying for a fraud detection system based on the value of fraudulent transactions prevented. For media companies, it could involve paying for a content recommendation engine based on the uplift in user engagement. This model forces a true partnership between vendor and customer, ensuring that both are aligned on achieving tangible business value.

3. Enterprise Data Tolls & API Economics

Data is the new oil, and the pipelines are getting expensive. As enterprise AI tools become more sophisticated, they require access to vast amounts of proprietary data. In response, software vendors are introducing new data access fees and API tolls, creating a complex and often costly landscape for enterprises to navigate. The legal battles between companies like Celonis and SAP over data access are just the beginning [5]. CIOs and CFOs must now budget for these ‘data tolls,’ which Constellation Research argues could be the biggest risk to scaling AI agents [5]. This trend underscores the critical importance of data ownership and the need for clear data governance strategies when negotiating SaaS contracts. As connection fees become the new cloud egress charges, enterprises must carefully evaluate the total cost of ownership for their AI initiatives, factoring in not just the cost of compute and storage, but also the cost of data access across multiple systems and vendors.

The Financial Impact of AI on Enterprise Budgets

The financial implications of AI adoption are profound and multifaceted. While AI promises significant cost savings and revenue growth, the upfront investment and ongoing operational costs can be substantial. A recent analysis by PwC found that 60% of executives believe that Responsible AI boosts ROI and efficiency, and 55% report improved business outcomes [15]. However, the reality on the ground is more complex. McKinsey data shows that only 19% of enterprises report revenue increases greater than 5% from AI, while 36% see no measurable change. This disparity highlights the critical importance of strategic planning, effective implementation, and continuous optimization.

| Financial Metric | Value/Percentage | Source |

| Executives Reporting AI Boosts ROI | 60% | PwC 2025 |

| Executives Reporting Improved Outcomes from AI | 55% | PwC 2025 |

| Enterprises with >5% Revenue Increase from AI | 19% | McKinsey |

| Enterprises with No Measurable Change from AI | 36% | McKinsey |

| CFOs Reporting Measurable ROI from AI | 14% | Medium/OriginTrail |

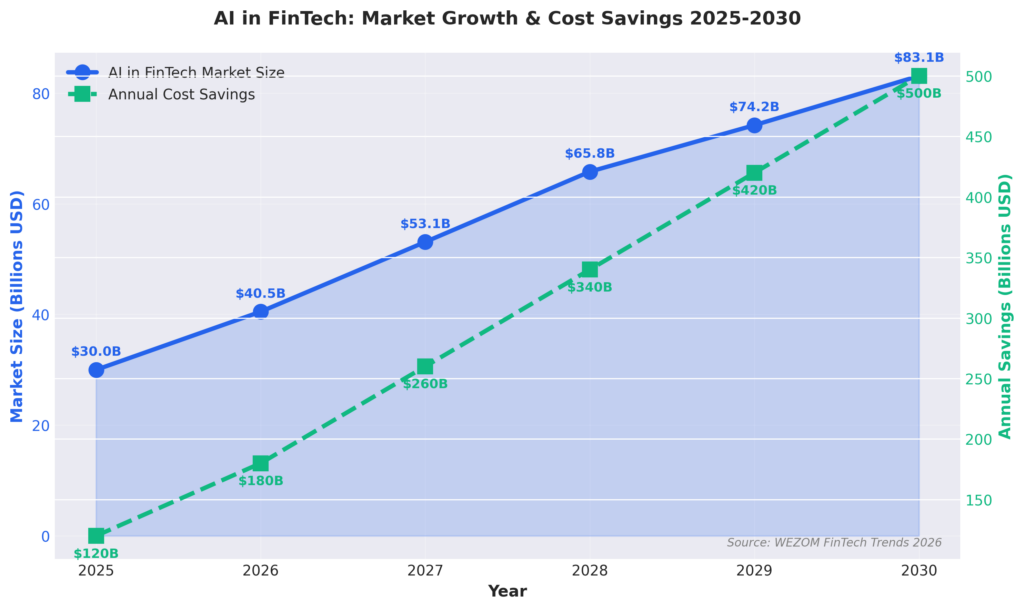

| Expected Annual Savings for Financial Industry by 2030 | $500 billion | WEZOM |

| AI Savings in Financial Industry (2025) | $120 billion | WEZOM |

| US Private AI Investment (2024) | $109.1 billion | Stanford AI Index |

| China Private AI Investment (2024) | $9.3 billion | Stanford AI Index |

For corporations in the FinTech, Software, and Media sectors, understanding these financial dynamics is essential. The decision to invest in AI is not just a technological one; it is a strategic business decision that requires careful financial modeling, risk assessment, and a clear understanding of the expected return. The companies that succeed will be those that can effectively manage the economics of AI, balancing the costs of implementation with the value generated.

Part 2: The AI-Native Foundation: Rebuilding the Tech Stack

The AI revolution is not about bolting on new features to old systems. It is about a fundamental architectural shift. To truly unlock the power of AI, enterprises must move from AI-enhanced to AI-native systems. This means rebuilding the technology stack from the ground up, with AI at its core. For companies in the Software, FinTech, and Media industries, this architectural transformation is a prerequisite for competitive advantage.

4. AI-Native Architecture & Neurosymbolic AI

Leading enterprises are moving beyond simply integrating AI models into existing applications. They are building AI-native architectures, where the entire system is designed around a continuously learning, agentic intelligence layer. This approach, often referred to as neurosymbolic AI, combines the probabilistic reasoning of neural networks with the deterministic logic of symbolic systems [7]. The result is applications that are not just intelligent but also reliable, governable, and context-aware. Imagine an ERP system that does not just report anomalies but proactively resolves them based on company policies, or a media platform that does not just recommend content but dynamically generates personalized user experiences. This is the promise of AI-native architecture, and it is rapidly becoming the new standard for enterprise software development.

5. Specialized Foundation Models for Enterprise

The one-size-fits-all approach to AI is fading. While general-purpose Large Language Models (LLMs) have demonstrated impressive capabilities, the future of enterprise AI lies in specialized foundation models. These models are trained on domain-specific data to perform specialized tasks with far greater accuracy and efficiency. In the FinTech sector, relational foundation models are being developed to analyze structured data from databases and transactional systems, enabling highly accurate predictions for tasks like credit scoring and fraud detection in a fraction of the time it takes with traditional machine learning [7]. For media companies, specialized models trained on video and audio data are revolutionizing content creation and analysis. As an enterprise, your ability to use corporate AI use cases will depend on selecting and fine-tuning the right specialized models for your unique business challenges.

6. AI Infrastructure Optimization (Hybrid Cloud)

The massive computational demands of AI are forcing a reckoning in infrastructure strategy. The cloud-first approach that dominated the last decade is giving way to a more nuanced hybrid cloud strategy. While the cloud offers unparalleled elasticity for training large models, on-premises infrastructure provides the consistent performance and cost predictability required for large-scale inference. As Deloitte notes, token costs have plummeted 280-fold in two years, yet some enterprises are facing monthly AI bills in the tens of millions [8]. The solution is a strategic blend of public cloud, private cloud, and on-premises data centers, optimized for the specific cost and performance requirements of different AI workloads. This AI infrastructure reckoning is a critical consideration for any enterprise looking to scale its AI initiatives sustainably.

7. Real-Time Data Processing & Edge AI

The value of data is often perishable. In industries like FinTech and Media, the ability to process and act on data in real time is a significant competitive advantage. This is driving the adoption of real-time data processing and Edge AI. By deploying AI models directly on edge devices–from factory floor sensors to a consumer’s smartphone–companies can analyze data at its source, minimizing latency and enabling instantaneous decision-making. In FinTech, this means real-time fraud detection at the point of transaction. In Media, it enables interactive, personalized content experiences. As the Internet of Things (IoT) continues to expand, the ability to process data at the edge will become increasingly critical for all enterprises.

Part 3: Governance, Security, and the Human-AI Workforce

As AI becomes more autonomous and deeply embedded in business processes, the challenges of governance, security, and workforce management are taking center stage. The rise of AI agents, in particular, is forcing enterprises to rethink their organizational structures and risk management frameworks. For corporations, navigating this new landscape requires a proactive and strategic approach to building a collaborative environment where humans and AI can work together effectively and securely.

8. Agentic Governance & Digital Workforce Management

The proliferation of AI agents within the enterprise is creating a new management challenge: agentic governance. As organizations deploy hundreds, or even thousands, of specialized AI agents to automate tasks, they risk an ‘agent sprawl’ that mirrors the shadow IT crises of the past, but with significantly higher stakes given the autonomous decision-making capabilities of these agents [7]. SAP highlights the need for a new discipline of digital workforce management, where AI agents are treated like digital coworkers, complete with onboarding, performance reviews, and continuous improvement cycles.

The governance framework for AI agents must address five critical dimensions. First, agent lifecycle management involves establishing version control, testing protocols, deployment approval processes, and retirement procedures for each agent. Second, observability and auditability require maintaining a comprehensive inventory of all agents, logging their activities, and capturing their reasoning paths and action traces. Third, policy enforcement means embedding business rules, regulatory constraints, and ethical guidelines directly into agent execution. Fourth, human-agent collaboration models define the boundaries of autonomy, approval requirements, and escalation pathways. Finally, performance monitoring tracks the accuracy, efficiency, cost, and business impact of each agent.

For FinTech companies, this governance framework is particularly critical. Financial institutions are subject to stringent regulatory oversight, and any AI system that makes decisions affecting customers must be transparent, auditable, and compliant with regulations like the EU AI Act and state-level laws such as Colorado’s SB 24-205 [9]. The failure to establish robust governance can result in regulatory fines, reputational damage, and loss of customer trust. For Software and Media companies, the stakes are equally high, as AI agents increasingly handle sensitive data and make decisions that impact user experiences and business outcomes. This requires a robust governance framework that addresses agent lifecycle management, observability, policy enforcement, and human-agent collaboration models. For any corporation looking to use AI tools inside the corporation at scale, establishing this governance framework is not just a best practice; it is a mission-critical necessity.

9. AI-Driven Cybersecurity

The same AI technologies that are driving business innovation are also being weaponized by malicious actors. The rise of AI-powered cyberattacks is forcing enterprises to adopt an AI-driven approach to cybersecurity. Traditional, signature-based security tools are no match for threats that can learn, adapt, and strike at machine speed. In 2026, the focus is on AI-powered threat detection, autonomous response systems, and predictive security analytics. These systems can identify and neutralize threats in real time, often without human intervention. For FinTech and Software companies, which are prime targets for cybercriminals, investing in AI-driven security is not just about protecting data; it is about ensuring business continuity and maintaining customer trust.

10. Sovereign AI & Digital Sovereignty

In an era of escalating geopolitical tensions and data privacy concerns, digital sovereignty has become a critical issue for enterprises and governments alike. The concept of Sovereign AI refers to the development and deployment of AI systems that are compliant with regional data residency and privacy regulations. The EU’s AI Act, with its high-risk obligations taking effect in 2026, is a major driver of this trend [9]. For US corporations operating globally, this means navigating a complex patchwork of international regulations and demanding AI and cloud solutions that are both cutting-edge and fully sovereign. This trend is accelerating the shift away from one-size-fits-all global cloud platforms toward regionally compliant, AI-powered enterprise platforms [7].

11. AI-Powered Compliance Automation

The regulatory landscape for FinTech, Media, and Software companies is becoming increasingly complex. From the EU’s AI Act and DORA to state-level regulations like Colorado’s SB 24-205, maintaining compliance is a significant operational burden [9]. AI-powered compliance automation is emerging as a critical solution. By leveraging AI to monitor transactions, analyze communications, and audit processes in real time, companies can ensure adherence to regulatory requirements with greater accuracy and efficiency. For financial institutions, this means automating anti-money laundering (AML) and know-your-customer (KYC) processes. For media companies, it involves automating content moderation and rights management. In 2026, regulatory compliance is no longer a manual, check-the-box exercise; it is an automated, continuous process driven by AI.

Industry-Specific Regulatory Challenges

The regulatory landscape varies significantly across industries, and AI-powered compliance solutions must be tailored to address these specific challenges. In FinTech, the focus is on anti-money laundering (AML), know-your-customer (KYC), and fraud prevention. The EU’s Markets in Crypto-Assets Regulation (MiCA), which is in its 18-month transitional period through mid-2026, is creating a comprehensive licensing regime for crypto companies [9]. AI systems can automate the monitoring of transactions, flagging suspicious activity in real time and ensuring compliance with these evolving regulations.

In the Software industry, the emphasis is on data privacy and security. The EU’s AI Act, with its high-risk obligations taking effect in August 2026, imposes strict requirements on AI systems used in financial services, employment, and customer eligibility decisions [9]. Software companies must ensure that their AI models are transparent, auditable, and free from bias. AI-powered compliance tools can automate the documentation of model training data, decision-making processes, and performance metrics, making it easier to demonstrate compliance to regulators.

For Media companies, the regulatory focus is on content moderation, intellectual property rights, and advertising standards. AI can automate the detection of prohibited content, ensure compliance with copyright laws, and monitor advertising placements to ensure they meet regulatory standards. The challenge for media companies is to balance the need for compliance with the imperative to preserve freedom of expression and editorial independence.

| Industry | Key Regulatory Challenges | AI-Powered Solutions |

| FinTech | AML, KYC, Fraud Prevention, MiCA Compliance | Real-time transaction monitoring, automated risk scoring, identity verification |

| Software | Data Privacy, AI Transparency, Bias Prevention (EU AI Act) | Automated model documentation, bias detection, explainability tools |

| Media | Content Moderation, Copyright Compliance, Advertising Standards | Automated content analysis, rights management, ad placement monitoring |

Part 4: The Transformation of Work and User Experience

AI is not just changing how businesses operate; it is fundamentally altering how humans interact with technology. The traditional graphical user interface (GUI) is giving way to more natural, intuitive, and intelligent forms of interaction. This shift is poised to unlock unprecedented levels of productivity and innovation, but it requires a new way of thinking about application design and workflow automation.

12. Intent-Driven ERP & Generative UI

The days of navigating complex menus and filling out endless forms are numbered. The future of enterprise software is the Generative UI, an interface that is dynamically created by AI to meet the specific needs of the user at a particular moment. This is the core principle behind the intent-driven ERP [7]. Instead of telling the system *how* to do something, the user simply expresses their *intent*–for example, “Prepare a trip to my customer with the most leads.” An AI agent then plans and executes the necessary steps, interacting with multiple backend systems and generating the required information and visualizations on the fly. This “no-app ERP” experience dramatically lowers adoption barriers and allows employees to focus on high-value work rather than administrative tasks. For any company looking to boost productivity, this is one of the most impactful corporate AI use cases.

The implications of this shift are profound. For FinTech companies, intent-driven ERP means that a loan officer can simply ask the system to “Prepare a loan package for this applicant,” and the AI will automatically gather credit reports, analyze financial statements, assess risk, and generate a recommendation–all without the officer needing to navigate multiple systems or manually compile data. For Software companies, it means that a product manager can ask the system to “Show me the features with the highest customer demand but lowest development cost,” and the AI will query multiple databases, run predictive models, and present a prioritized roadmap. For Media companies, it means that a content producer can ask the system to “Create a highlight reel of today’s top stories,” and the AI will analyze video feeds, identify key moments, and automatically edit and publish the content.

This is not science fiction; it is happening now. Companies that embrace intent-driven ERP and generative UI will see dramatic improvements in employee productivity, faster time-to-market for new products and services, and higher levels of customer satisfaction. The key is to invest in the underlying AI infrastructure–including natural language processing, knowledge graphs, and agentic systems–that makes these experiences possible.

13. Decision Velocity Automation

The true power of AI in the enterprise lies not in its ability to perform single tasks, but in its capacity to automate entire decision-making processes. Decision velocity–the speed at which smaller, interconnected decisions can be automated at scale–is a key theme for 2026. According to Constellation Research, leading organizations are already achieving 5x to 10x improvements in process efficiency by collapsing complex decision trees into automated workflows [5]. This is not about replacing human decision-makers, but about augmenting their capabilities, freeing them from routine analysis to focus on strategic exceptions and high-stakes judgments. As one expert puts it, “Agentic AI is a feature, and the real deal is decision velocity” [5].

14. Physical AI & Robotics Convergence

While much of the focus has been on software, AI is also making significant inroads into the physical world. The convergence of AI and robotics is giving rise to Physical AI, a trend that is set to transform industries like manufacturing, logistics, and even media production. Vision-language-action models are enabling robots to understand and interact with their environment with unprecedented dexterity and intelligence [7]. In manufacturing, this means more flexible and adaptive production lines. In logistics, it enables autonomous warehouse operations. For media companies, it opens up new possibilities for automated camera work and set management. The rise of physical AI is a clear signal that the impact of artificial intelligence will extend far beyond the digital realm.

15. Multimodal AI Enterprise Systems

The next wave of AI is multimodal. AI systems are no longer limited to processing a single type of data, like text or images. Multimodal AI can understand and reason across text, images, audio, and video simultaneously. For enterprises, this unlocks a wealth of new possibilities. A FinTech company could analyze a loan application by processing not just the written form, but also a video interview with the applicant. A media company could automatically generate a highlight reel from a live event by analyzing both the video feed and the audio commentary. In 2026, multimodality is moving from a niche capability to a core component of enterprise AI tools, enabling a more holistic and context-rich understanding of the business environment.

Real-World Applications of Multimodal AI

The practical applications of multimodal AI are vast and varied. In FinTech, multimodal AI can enhance fraud detection by analyzing not just transaction data, but also voice patterns during customer service calls, facial expressions during video KYC processes, and even the metadata from uploaded documents. This multi-layered analysis provides a much richer understanding of risk than any single data type could provide. A bank could, for example, use multimodal AI to detect synthetic identity fraud by cross-referencing a customer’s photo ID with their video interview and their social media profiles, identifying inconsistencies that would be invisible to a human reviewer.

In the Software industry, multimodal AI is revolutionizing user experience design and testing. By analyzing user interactions across text inputs, voice commands, and visual navigation patterns, software companies can gain a comprehensive understanding of how users engage with their products. This enables more intuitive interface design, better accessibility features, and more effective onboarding processes. A SaaS company could use multimodal AI to automatically generate user guides by analyzing screen recordings, user feedback, and support tickets, creating documentation that addresses the most common pain points.

For Media companies, multimodal AI is a game-changer for content creation and distribution. AI systems can analyze video footage, audio tracks, and text scripts simultaneously to automatically generate subtitles, translations, and accessibility features. They can also create personalized content recommendations by analyzing a user’s viewing history, search queries, and even their emotional reactions captured through facial recognition (with appropriate consent). A streaming service could use multimodal AI to automatically generate trailers for new shows by identifying the most engaging scenes based on viewer reactions to similar content.

| Industry | Multimodal AI Application | Business Impact |

| FinTech | Fraud detection using transaction data, voice, video, and document analysis | Reduced fraud losses by 40%, faster KYC processes |

| Software | User experience optimization through analysis of text, voice, and visual interactions | Improved user satisfaction, reduced churn, faster onboarding |

| Media | Automated content creation and personalization using video, audio, and text | Increased viewer engagement, reduced production costs, personalized experiences |

Part 5: The Strategic Imperative: Talent, Specialization, and the Build vs. Buy Dilemma

As AI becomes a central pillar of enterprise strategy, the focus is shifting to the human and organizational elements required for success. The war for AI talent is intensifying, the debate over building versus buying AI solutions is becoming more nuanced, and the need for industry-specific expertise is growing. For corporations, navigating these strategic imperatives is the final and most critical piece of the AI puzzle.

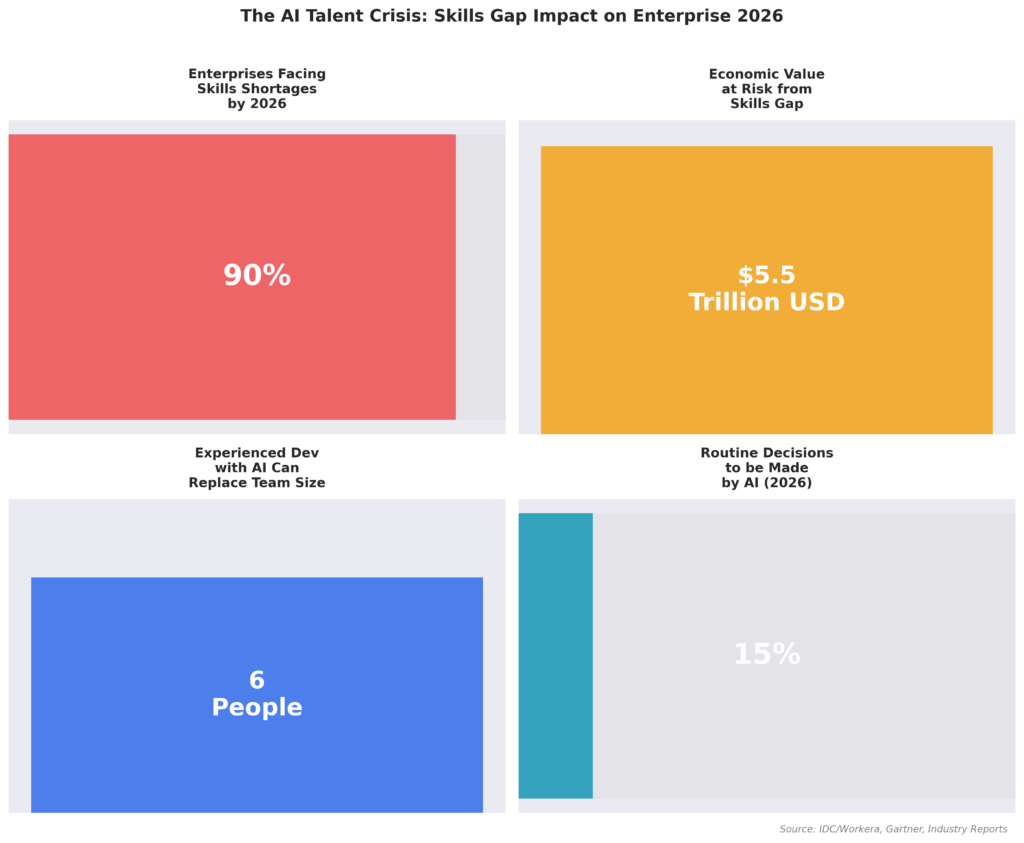

16. AI Talent Acquisition & The Skills Gap

The demand for AI expertise is far outstripping supply, creating a massive AI talent shortage. Over 90% of global enterprises are projected to face critical skills shortages by 2026, putting an estimated $5.5 trillion in economic growth at risk [10]. The competition to hire AI engineers, data scientists, and AI strategists is fierce. This is not just about hiring coders; it is about finding individuals who can bridge the gap between technology and business, who understand how to apply AI to solve real-world problems. For companies like Correct Context, which specialize in IT staff augmentation, this talent gap represents a significant opportunity. For enterprises, it underscores the urgent need to invest in upskilling their existing workforce and building strategic partnerships to access the talent they need to succeed.

Strategies for Addressing the AI Talent Gap

Addressing the AI talent shortage requires a multi-faceted approach. First, enterprises must invest in training and upskilling their existing workforce. This means providing employees with access to AI education programs, certifications, and hands-on experience with AI tools. Companies that successfully upskill their workforce can reduce their dependence on external hiring and build a culture of continuous learning and innovation.

Second, enterprises should partner with IT staff augmentation providers to access specialized AI talent on demand. Companies like Correct Context offer a flexible solution, allowing enterprises to hire AI programmers and hire AI coders for specific projects without the long-term commitment of full-time employment. This approach is particularly valuable for companies that need to scale their AI initiatives quickly or require expertise in niche areas of AI.

Third, enterprises must build a compelling employer brand that attracts top AI talent. This means offering competitive compensation, providing opportunities for professional development, and fostering a culture of innovation and experimentation. Companies that are known for their cutting-edge AI work and their commitment to employee growth will have a significant advantage in the war for talent.

Finally, enterprises should collaborate with universities and research institutions to build a pipeline of future AI talent. This can involve sponsoring research projects, offering internships and co-op programs, and participating in industry-academic partnerships. By investing in the next generation of AI professionals, companies can ensure a steady supply of talent for the long term.

| Strategy | Description | Benefits |

| Upskilling Existing Workforce | Provide AI training, certifications, and hands-on experience | Reduced hiring costs, increased employee retention, culture of innovation |

| IT Staff Augmentation | Partner with providers to access specialized AI talent on demand | Flexibility, access to niche expertise, faster project scaling |

| Build Employer Brand | Offer competitive compensation, professional development, and innovation culture | Attract top talent, reduce time-to-hire, improve employee satisfaction |

| University Partnerships | Sponsor research, offer internships, participate in academic collaborations | Pipeline of future talent, access to cutting-edge research, brand visibility |

17. In-House Forward-Deployed Engineers

Borrowing a page from the playbook of companies like Palantir, software vendors are increasingly offering “forward-deployed engineers” to help customers implement their AI solutions. However, in 2026, enterprises are realizing that they need their own in-house forward-deployed engineers [5]. These internal AI specialists possess a deep understanding of the business, the industry, and the company’s unique data and processes. They are essential for translating the generic capabilities of AI platforms into custom solutions that drive real business value. The decision to hire AI programmers and build this internal capability is a strategic one, as it reduces vendor dependency and ensures that AI initiatives are tightly aligned with business objectives.

18. Vertical SaaS Specialization

The SaaS market is moving away from horizontal, one-size-fits-all solutions toward Vertical SaaS. These are cloud-based applications designed for the specific needs of a particular industry. The Vertical SaaS market is projected to grow at a compound annual growth rate of 23.9%, nearly double the pace of the broader SaaS market [11]. For FinTech, Media, and Software companies, this means access to a growing ecosystem of specialized tools that are pre-configured for their unique workflows and regulatory requirements. From AI-powered regulatory reporting for banks to AI-driven content management for media companies, Vertical SaaS solutions offer a faster path to value than building from scratch.

19. The Build vs. Buy Shift in Enterprise Software

The age-old debate of build vs. buy is being re-framed by AI. As AI agents make it easier to create custom applications, and as enterprises push back against rising SaaS costs, the pendulum is swinging back toward building. In 2026, many organizations are concluding that custom applications, tailored to their specific use cases, offer a greater competitive advantage than off-the-shelf software [5]. AI is acting as an abstraction layer, allowing companies to build new, intelligent user experiences on top of their existing legacy systems. This shift does not mean the end of SaaS, but it does signal a move toward a more hybrid approach, where enterprises buy platforms and build differentiated applications on top of them.

20. AI in Media Production & Distribution

For the media industry, AI is a transformative force, reshaping every aspect of the value chain from content creation to distribution. AI in media production is enabling the creation of virtual actors, synthetic celebrities, and automated special effects [12]. In distribution, AI algorithms are optimizing content delivery, personalizing user experiences, and maximizing advertising revenue. News organizations are shifting their focus from using AI in production to leveraging it for distribution and monetization [13]. For media enterprises, the ability to harness these AI capabilities is not just an opportunity for innovation; it is a matter of survival in an increasingly competitive market.

Conclusion: The Path Forward in the AI-Driven Enterprise

The trends outlined in this article are not disparate threads; they are interwoven components of a single, powerful narrative: the rise of the AI-driven enterprise. For leaders in FinTech, Software, and Media, the path forward is clear, albeit challenging. It requires a holistic strategy that addresses not just technology, but also economics, governance, talent, and culture.

The journey begins with a new economic model, one that embraces the flexibility of Agentic Enterprise License Agreements and the accountability of outcome-based pricing. It demands a fundamental rebuilding of the technology stack, moving toward AI-native architectures and specialized foundation models. It necessitates a new approach to governance and security, one that can manage a digital workforce of AI agents and defend against AI-powered threats.

Ultimately, success in the age of AI will be defined by people. It will depend on your ability to hire AI engineers and cultivate a culture of continuous learning. It will be determined by your strategic decisions on when to build and when to buy, when to partner and when to lead. The corporate AI use cases are limitless, but the window of opportunity is not. The time to act is now. The future of your enterprise depends on it.

Key Takeaways for Enterprise Leaders

As we conclude this comprehensive exploration of the 20 SaaS and AI trends shaping 2026, it is essential to distill the key takeaways for enterprise leaders in FinTech, Software, and Media:

- Embrace the New Economics: The shift to agentic enterprise license agreements and outcome-based pricing models requires a new approach to budgeting and vendor management. Focus on long-term value and strategic partnerships.

- Rebuild Your Tech Stack: Moving to AI-native architectures and specialized foundation models is not optional; it is a competitive necessity. Invest in hybrid cloud infrastructure and real-time data processing capabilities.

- Prioritize Governance and Security: As AI agents proliferate, establish robust governance frameworks and invest in AI-driven cybersecurity. Compliance is not a burden; it is a competitive advantage.

- Transform the User Experience: Intent-driven ERP and generative UI are the future of enterprise software. Focus on decision velocity and empower your employees with AI-powered tools.

- Invest in Talent: The AI talent shortage is real and growing. Upskill your workforce, partner with IT staff augmentation providers, and build a compelling employer brand to attract top talent.

- Specialize and Customize: Vertical SaaS and custom AI applications offer a faster path to value than generic solutions. Embrace the build vs. buy debate with a strategic mindset.

- Leverage Multimodal AI: The ability to process and reason across multiple data types is a game-changer. Invest in multimodal AI to unlock new use cases and competitive advantages.

- Prepare for Physical AI: The convergence of AI and robotics is transforming manufacturing, logistics, and media production. Stay ahead of the curve by exploring physical AI applications.

- Navigate Sovereign AI: Digital sovereignty is a critical issue for global enterprises. Ensure your AI solutions are compliant with regional regulations and data residency requirements.

- Measure and Optimize ROI: The majority of AI initiatives fail to deliver measurable ROI. Focus on clear business objectives, rigorous measurement, and continuous optimization.

The AI revolution is not a distant future; it is the present reality. The enterprises that thrive in 2026 and beyond will be those that embrace these trends, invest strategically, and execute with discipline. For companies in FinTech, Software, and Media, the stakes have never been higher, and the opportunities have never been greater. The question is not whether to adopt AI, but how to do so in a way that creates sustainable competitive advantage. The answer lies in understanding these 20 trends and taking decisive action today.

About Correct Context

We are a leading IT staff augmentation provider specializing in helping enterprises hire AI engineers, hire AI programmers, and hire AI coders to accelerate their digital transformation initiatives. With deep expertise in FinTech, Software, and Media industries, we connect corporations with top-tier AI talent in CEE to drive innovation and competitive advantage. Fill the form and let us know how we can enhance your business https://correctcontext.com/contact-us/

References

[1] Vena Solutions (2026), 85 SaaS Statistics, Trends and Benchmarks for 2026

[2] Stanford University (2025), Artificial Intelligence Index Report 2025

[3] Fortune (2025), MIT report: 95% of generative AI pilots at companies are failing

[4] Medium (2026), 5 Trends to drive the AI ROI in 2026: Trust is Capital

[5] Constellation Research (2026), Enterprise technology 2026: 15 AI, SaaS, data, business trends to watch

[7] SAP News Center (2026), AI in 2026: Five Defining Themes

[8] Deloitte Insights (2025), Tech Trends 2026

[9] WEZOM (2025), Fintech Trends in 2026: AI, Regulation, and Future of Industry

[10] Workera (2026), The $5.5 Trillion Skills Gap: What IDC’s New Report Reveals About AI Workforce Readiness

[11] Tridens Technology (2025), Top 6 SaaS Industry Trends for 2026

[12] Bernard Marr (2026), 7 Media Trends That Will Redefine Entertainment In 2026

[13] Reuters Institute (2026), How will AI reshape the news in 2026?

[14] McKinsey & Company (2025), The State of AI: Global Survey 2025

[15] PwC. (2026), 2026 AI Business Predictions

Table of content

- Understanding the Landscape: Market Dynamics and Adoption Rates

- Part 1: The New Economics of Enterprise AI

- Part 2: The AI-Native Foundation: Rebuilding the Tech Stack

- Part 3: Governance, Security, and the Human-AI Workforce

- Part 4: The Transformation of Work and User Experience

- Part 5: The Strategic Imperative: Talent, Specialization, and the Build vs. Buy Dilemma

- Conclusion: The Path Forward in the AI-Driven Enterprise

- About Correct Context